Investing in the stock market can be a daunting task, but it can also be an effective way to grow your wealth. However, it’s important to have a plan in place before you begin investing. This is where portfolio management comes into play. In this article, we’ll take a look at what portfolio management is, the key elements of portfolio management, how to analyse your investment, and the best portfolio management services in Pune.

What is portfolio management?

Portfolio management is the art and science of managing a collection of investments, known as a portfolio, with the goal of achieving a specific investment objective. The objective can be anything from generating income to achieving long-term capital growth. Portfolio management includes the assessment of individual investments to determine their suitability for the portfolio’s overall objectives. Additionally, portfolio management involves analysing how different investments complement each other to achieve the desired outcome.

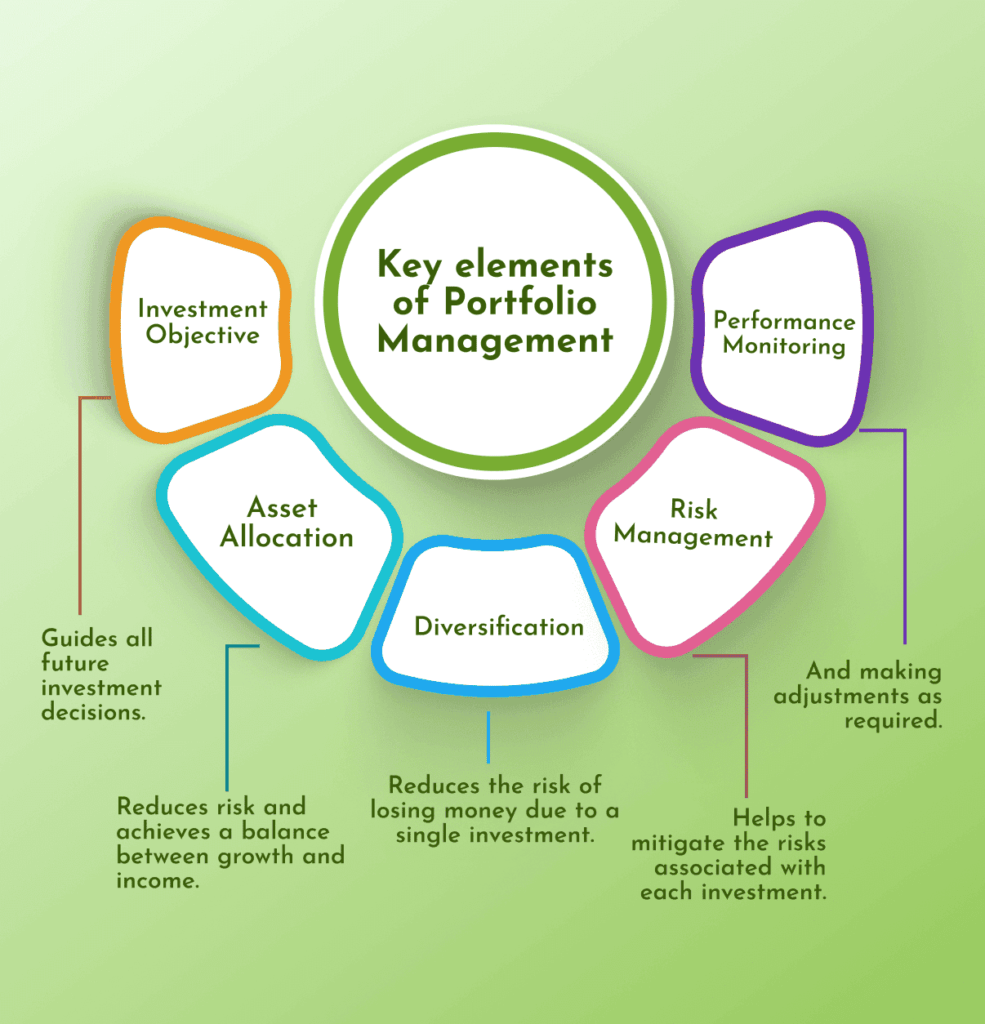

Key elements of portfolio management

There are several key elements of portfolio management that every investor should be familiar with:

- Investment objective: The first step in portfolio management is to determine your investment objective. This will guide all future investment decisions.

- Asset allocation: Asset allocation refers to the process of dividing your portfolio among different types of assets, such as stocks, bonds, gold, real estate and cash. This helps to reduce risk and achieve a balance between growth and income.

- Diversification: This strategy involves entering a position when a security pulls back from a recent high or low. Traders can use technical indicators such as Fibonacci retracement or Bollinger Bands to identify potential pullback levels, and enter a position when the price bounces off the level.

- Risk management: Risk management involves evaluating the risks associated with each investment and taking steps to mitigate those risks.

- Performance monitoring: Finally, portfolio management involves monitoring the performance of your portfolio and making adjustments as needed to keep it on track with your investment objective.

How should you analyse your investment?

Before investing in any stock, it’s important to conduct a thorough analysis to ensure that it’s a good fit for your portfolio. Here are some key factors to consider:

- Financial performance: Look at the company’s financial statements, such as its balance sheet, income statement, and cash flow statement. This will give you an idea of the company’s financial health and whether it’s generating consistent profits.

- Competitive advantage: Does the company have a competitive advantage in its industry? This can come in the form of proprietary technology, strong brand recognition, or a large customer base.

- Management team: A company’s management team plays a critical role in its success. Look for a team with a track record of success and a clear vision for the future.

- Valuation: Finally, consider the company’s valuation. Is the stock priced fairly given its financial performance and growth prospects?

- Bonds: When analysing bonds, consider the credit rating of the issuer, the yield-to-maturity, the duration, and the overall interest rate environment.

- Alternative investments: Alternative investments, such as private equity, hedge funds, and commodities, require a different type of analysis. For private equity and hedge funds, look at the investment strategy, track record, fees, and liquidity. For commodities, consider supply and demand dynamics, geopolitical risks, and storage costs.

- Economic factors: Economic factors, such as inflation, interest rates, and overall market trends, can impact the performance of investments across all asset classes.

- Geopolitical risks: Geopolitical risks, such as wars, sanctions, or trade tensions, can impact the performance of investments in various asset classes, particularly stocks and commodities.

- ESG factors: Environmental, social, and governance (ESG) factors are becoming increasingly important for investors across all asset classes. Consider a company’s environmental impact, social responsibility, and governance practices when analysing its potential as an investment.

- Liquidity: Liquidity is an important factor to consider when analysing investments, particularly for alternative investments or real estate. Consider how easy it is to buy or sell the investment, and how quickly you can access your funds if needed.

Overall, a comprehensive analysis of any investment should consider the risk-return trade-off, diversification benefits, and how the investment fits into your overall portfolio objectives.

Best portfolio management services in Pune:

If you’re looking for professional help with portfolio management, there are several services available in Pune. Here are some of the best:

- Wealth Note Investments: Wealthnote Share Market Classes is a Pune-based financial services company that offers portfolio management services to its clients. They provide personalised investment solutions based on your financial goals, risk appetite, and investment horizon. Their team of experienced professionals uses a research-driven approach to construct and manage your portfolio.Wealth Note Investments prioritises personalised investment solutions based on individual financial goals, risk appetite, and investment horizon, which allows for a tailored approach to portfolio management that aligns with the unique needs and objectives of each client.

- Arthashastra Investment Managers Pvt Ltd: Arthashastra Investment Managers is a Pune-based wealth management firm that offers portfolio management services to clients. They offer customised investment solutions based on your financial goals and risk tolerance.

- Fin-Astra Capital: Fin-Astra Capital is a boutique investment advisory firm in Pune that provides portfolio management services. They offer a range of investment solutions, including mutual funds, equity, debt, and alternative investments.

- FinVise India: FinVise India is a financial planning and advisory firm based in Pune that offers portfolio management services. They provide customised investment solutions based on your financial goals and risk appetite.

- Plutus Wealth Management LLP: Plutus Wealth Management is a Pune-based financial services firm that offers portfolio management services to clients. They offer investment solutions in mutual funds, equity, debt, and other asset classes.

Also Read: Options Trading Course

Conclusion

In conclusion, portfolio management is crucial for successful stock market investing. By analysing investments, considering risk, and aligning with investment goals, you can achieve success. Professional portfolio management services are available for those who prefer assistance, but it’s important to consider factors such as track record, fees, and personalised service when selecting a provider. Working with a reputable service can ensure your portfolio is well-managed and on track to meet your investment goals.

FAQs

Portfolio management involves strategically managing your investments to achieve financial goals. It’s crucial because it helps you balance risk and returns while aligning with your long-term objectives.

Look for services with a proven track record, transparent processes, and personalized solutions. Reading reviews and checking credentials can help you make an informed choice.

Professional management offers expertise, time savings, and tailored strategies to maximize returns while minimizing risks, ensuring your investments align with your goals.

While self-management is possible, it requires time, knowledge, and constant monitoring. Professionals can provide insights and strategies that may be difficult to achieve independently.

Consider factors like fees, performance history, customer reviews, and whether the service aligns with your financial goals and risk tolerance.