Selecting the right broker is a crucial decision for investors. The brokerage firm you choose will play a significant role in your investment journey, affecting factors such as costs, services, support, and available investment options. This article aims to provide a comprehensive guide to help you make an informed decision when selecting a broker. Additionally, we will explore the key differences between full-service brokers and discount brokers, enabling you to understand which type suits your investment needs.

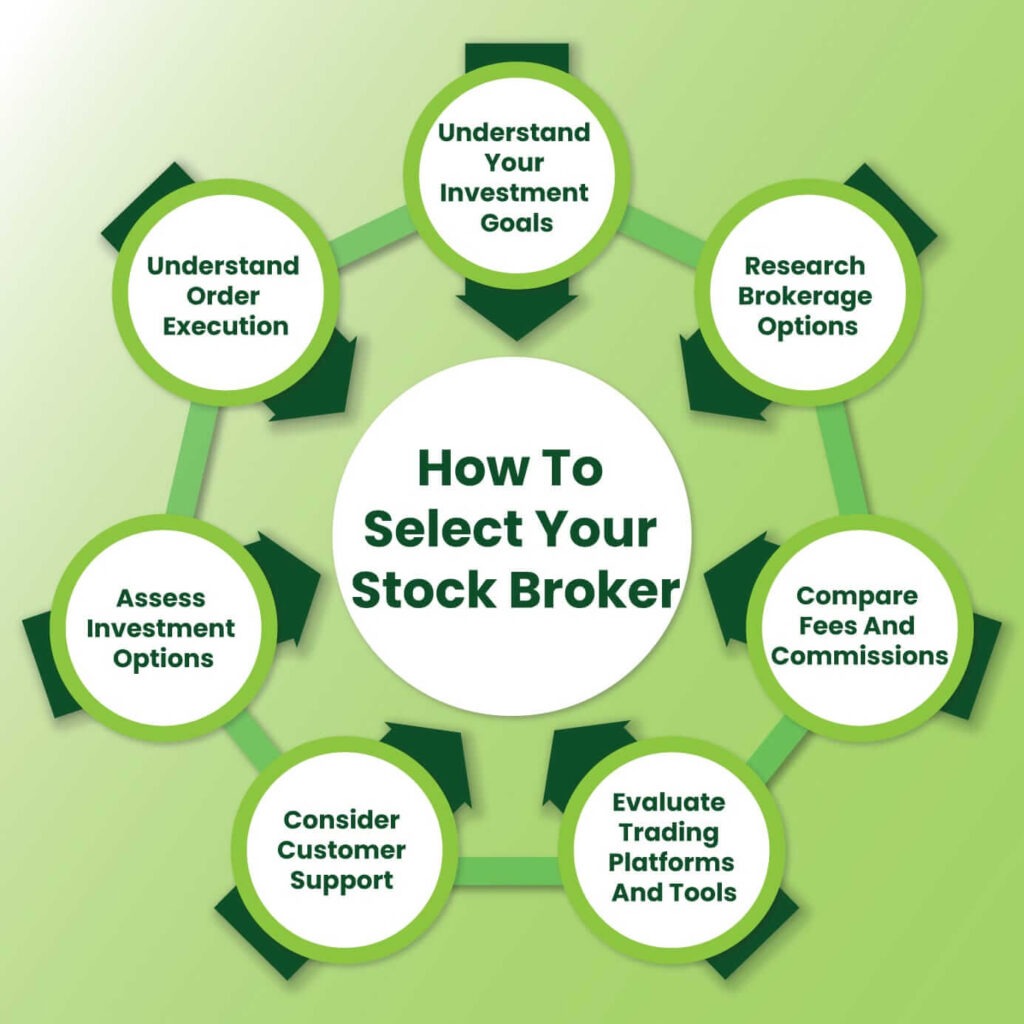

How to Select your Stock Broker

- Understand Your Investment Goals:Before diving into the selection process, it is essential to define your investment goals. Are you a long-term investor looking for retirement planning? Or perhaps a short-term trader seeking to capitalise on market opportunities? Understanding your objectives will help narrow down the broker options that align with your investment style.

- Research Brokerage Options:The next step is to research and explore the available brokerage options. Consider factors such as reputation, reliability, experience, and regulatory compliance. Look for reviews, ratings, and customer feedback to gain insights into the broker’s performance, customer service, and overall satisfaction levels. Reputable brokers often provide transparency and have a strong track record of serving their clients.

- Compare Fees and Commissions:Fees and commissions can significantly impact your investment returns. Full-service brokers typically charge higher fees due to the personalised guidance and comprehensive services they offer. On the other hand, discount brokers have lower fees but may provide fewer services. It is crucial to compare the fee structure of different brokers and determine which aligns with your budget and investment strategy.

- Evaluate Trading Platforms and Tools:The trading platform provided by the broker is an essential aspect to consider. A user-friendly, feature-rich platform can enhance your trading experience. Look for platforms that offer real-time data, research tools, charting capabilities, and order execution options. Some brokers also provide mobile applications, allowing you to monitor and manage your investments on the go.

- Consider Customer Support:Reliable customer support is vital, especially for new investors. Check the broker’s availability and responsiveness through various channels such as phone, email, live chat, or dedicated support staff. Prompt and knowledgeable support can be invaluable when you encounter issues or have questions about your account or trades.

- Assess Investment Options:Different brokers offer varying investment options. If you primarily trade stocks, ensure that the broker provides access to the stock exchanges and markets you are interested in. Similarly, if you are interested in other asset classes such as bonds, mutual funds, ETFs, or options, confirm that the broker offers those instruments. Having a wide range of investment options can help you diversify your portfolio effectively.

- Understand Order Execution:The speed and accuracy of order execution can significantly impact your trading outcomes. Research how brokers handle order execution, including whether they use market orders, limit orders, or other types of orders. Additionally, consider factors such as order routing, trade execution speeds, and the broker’s reputation for executing trades efficiently.

Full-Service Brokers vs. Discount Brokers

Now, let’s delve into the key differences between full-service brokers and discount brokers:

| Aspect | Full-Service Brokers | Discount Brokers |

|---|---|---|

| Services Provided | Comprehensive range of services: personalised investment advice, research reports, portfolio management, retirement planning, tax advice, etc. | Basic trading services without extensive research or advisory services. |

| Fees and Commissions | Higher fees and commissions due to additional services offered. | Lower fees and commissions. |

| Ideal for | Investors who prefer professional guidance, have complex financial needs, or have larger portfolios. | Self-directed investors who are comfortable making their own investment decisions and do not require personalised advice or additional services. |

| Additional Services | Offer a wide range of additional services to cater to various financial needs. | Typically do not provide extensive additional services beyond basic trading functions. |

| Research and Analysis | Provide in-depth research reports, market insights, and investment recommendations. | May offer limited research tools and resources. |

| Investment Guidance | Offer personalised investment advice and guidance based on individual goals and risk tolerance. | Do not provide personalised advice but may offer educational resources for self-directed investors. |

It’s important to note that these are general characteristics, and individual brokers within each category may have variations in their offerings and services. Investors should carefully assess their own needs and preferences before choosing between a full-service broker or a discount broker.

Identifying and Avoiding Broker Malpractices

While the majority of brokers operate ethically and responsibly, it’s crucial to be aware of potential malpractices and take steps to protect yourself as an investor.

Here are some common broker malpractices to be mindful of:

- Unauthorised Trading:Unauthorised trading occurs when a broker executes trades in a client’s account without obtaining proper authorization. This can involve excessive trading (churning) to generate commissions or making trades that do not align with the client’s investment objectives. Regularly review your account statements and trade confirmations to ensure all trades were authorised.

- Misrepresentation and False Information:Brokers should provide accurate and transparent information about investment products, risks, fees, and performance. Be cautious of brokers who misrepresent investment opportunities or provide false information to lure clients. Conduct independent research and verify any claims made by brokers before making investment decisions.

- High-Pressure Sales Tactics:Some brokers may employ high-pressure sales tactics to push clients into making hasty investment decisions. They may create a sense of urgency, use aggressive language, or make unrealistic promises of high returns. Take your time to thoroughly evaluate investment opportunities and never feel pressured to make immediate decisions.

To protect yourself from broker malpractices, follow these preventive measures:

- Conduct thorough research on brokers before opening an account. Check their regulatory status, disciplinary history, and reputation.

- Read and understand all account agreements and documentation, including the fine print.

- Keep detailed records of all communication, transactions, and account statements.

- Regularly review your account statements and trade confirmations for any unauthorised activity.

- Stay informed about financial markets and investment products to identify potential red flags.

- Report any suspected malpractices to the appropriate regulatory authorities.

Also Read: Basics of Stock Market: What You Need to Know Before Investing

Conclusion

Choosing the right broker is a significant step in your investment journey. By considering factors such as your investment goals, fees and commissions, trading platforms, customer support, investment options, order execution, and regulatory compliance, you can make an informed decision.

Additionally, understanding the differences between full-service brokers and discount brokers allows you to align your needs and preferences with the appropriate type of broker. Remember to conduct thorough research, seek recommendations, and take advantage of demo accounts or trial periods to ensure you select a broker that best serves your investment goals and preferences.

FAQs

Look for low brokerage fees, a user-friendly trading platform, strong customer support, and a broker with a good reputation. Ensure they offer the tools and resources you need for your investment goals.

Compare brokerage fees by checking their pricing structure (flat fee vs. percentage), hidden charges like AMC or transaction fees, and any additional costs for research tools or premium services.

A reliable trading platform is crucial—it should be fast, secure, and easy to use. Look for features like real-time data, advanced charting tools, and mobile accessibility to enhance your trading experience.

Avoid choosing a broker solely based on low fees, ignoring platform quality, or overlooking customer reviews. Also, ensure the broker is regulated and offers the services you need.

Check if the broker is registered with regulatory authorities like SEBI (in India). Read customer reviews, verify their track record, and ensure they have transparent policies.

For beginners, look for brokers with educational resources, demo accounts, low fees, and intuitive platforms. Popular choices include Zerodha, Groww, and Upstox in India.