Share Market Trading Course

- Home

- >>

- Courses

- >>

- Share Market Trading Course

Duration

6 Weeks/ 2 Hours Daily

Modules

No. of modules – 12

Training

Online & Offline Batches

Enroll Now

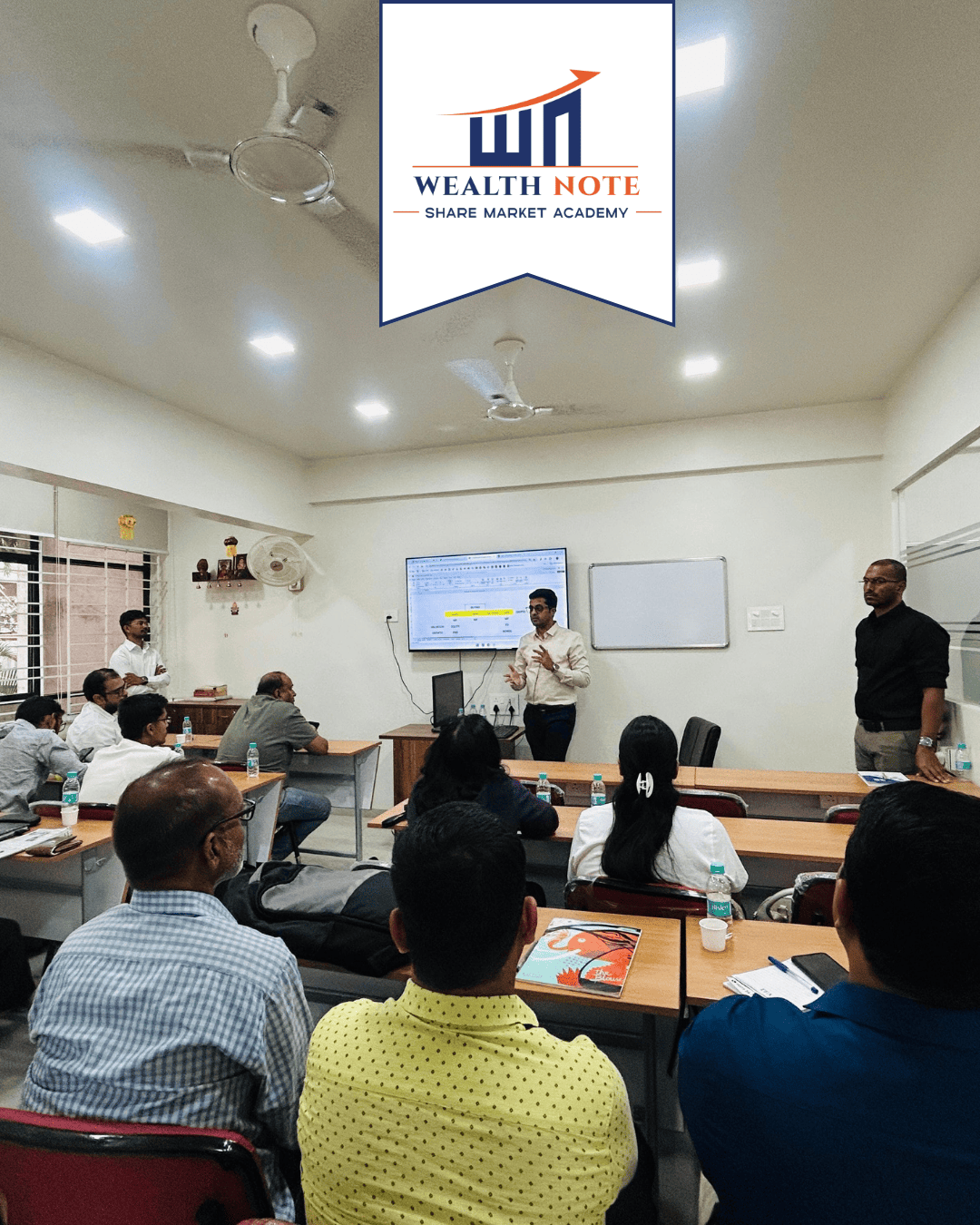

Share Market Trading Course

“ Mastering the Stock Market: A Complete Share Trading Course for Beginners to Pros”

Unlock the secrets of profitable trading with our structured, practical, and easy-to-understand the share trading course. Whether you are starting from scratch or looking to sharpen your trading edge, this course guides you through proven strategies, risk management, technical analysis, and real-world execution — all designed to turn you into a confident, self-sufficient trader.

Join our 6-week Stock Market Trading Course in Pune, tailored for beginners to pro and those looking to build a strong foundation in share trading.

This Course is designed for

Salaried Professional

Businessmen

Students

Housewives

Engineers

MBA Professional

Charted Accountants

Retired Individuals

Course Features

- In-Depth Learning Modules: Understand how stock markets, indices, and trading platforms work

- Technical Analysis: Master chart patterns and technical indicators.

- Fundamental Analysis: Understand company analysis through financial data.

- Expert Trading & Investment Guidance - For Smarter Financial Decisions.

- 100% Practical Training & skill-oriented courses - For Real-World Success.

- Risk Management Techniques: Protect your capital using stop-loss, risk-reward ratios, and position sizing.

- Continuous mentorship or Q&A Support - Ongoing mentorship and expert Q&A support whenever you need it.

- Build emotional discipline with trading psychology - Master the market with strong trading psychology.

Post Share Market Course Benefits

Modules

- Share market and its function

- Exchanges, Brokers, Investors

- Trading, Demat account

- Intraday, Delivery and Investment

- Bull vs Bears, Long vs Short

- Intraday vs Delivery Settlement

- Market Cap – Large, Mid, Small

- Volume, Turnover, Market Depth

- Price Bands and Circuit Filters

- Quarterly Settlement, Zeroizing

- Index - Broad and Sector

- Index calculations and contributors

- Leverage, Margin, MTF

- Leverage on shares

- Candles – Open, High, Low, Close

- Trading View Website Demo

- Trading Strategy – Trend, Level, Signal

- Candle Patterns, Support and Resistance

- Trend Lines – Up trend and Down trend

- Support, Resistance and Trendlines

- Uptrend, Downtrend, Sideways trend

- Breakout, Breakdown and Bumps

- Moving Average Indicator

- Moving Average Convergence Divergence

- Average True Range Indicator

- Trend Momentum Combination

- Relative Strength Index Indicator

- Golden and Death Crossovers

- Volume and Weighted Volume

- Volume Weighted Average Price

- International Events and News

- Geopolitical Events and News

- Government Announcements

- Crude Oil, Natural Gas Data

- Bullion and Metals Data

- Currency News and Data

- Federal Bank Commentaries

- Inflation, Interest Rate Data

- Monetary Policy Events

- GDP Growth Data

- Import Export Data and News

- Sector Data and Events

- Company Specific News and Events

- Quarterly and Annual Results

- FII and DII inflow outflow

- Insider Trading, Bulk Deals

- Stock Price vs Business Performance

- What are Annual Reports, Financial Statements

- Balance Sheet: Assets and Liabilities

- How to Read a Profit and Loss Statement

- Cash Flow Statement: Operating, Financial

- Key Financial Ratios: ROE, ROCE, ROA etc

- Valuation Ratios: P/E, PEG, P/B Ratio

- Sector and Industry Analysis

- Understanding Business and Revenue Models

- Understanding Growth and Scalability

- Business Cycles and Trends

- Economic Moats and Competitive Advantages

- Shareholding Pattern and Institutional Activity

- Corporate Actions and Announcements

- Checklist Approach to Investing

- Importance of Savings

- Time value and Compounding

- Rules of Trading Money Management

- Mutual funds for all needs

- Insurance – Life, health, motor

- Investing and Trading Allocation

- Delivery and Intraday Allocation

- Equity, Currency, Commodity Allocation

- Reinvesting of Profits and Reallocation

- Rules of Trading Money Management

- Quantity control for managing risk

- Importance of Risk Management

- Reward to Risk ratio, Win Rate

- Use of ATR Indicator for Stoploss

- Time value of money

- Profit maximizing by trailing stop loss

- Trading App and Website Demo

- Funds Pay in and Payout

- Margin and Collateral Utilization

- Symbol Info and Market Stats

- Market, Limit and Stoploss Orders

- Intraday, Delivery and MTF Orders

- Disclosed Quantity, Order Validity

- Limit, Market and Stoploss Orders

- Order Book, Pending and Executed Orders

- Day and Net Positions, Holdings Window

- Ledger Statement and Narrations

- Profit and Loss statement in all segments

- Understanding Contract Note

- Understanding all costs and taxes

- POA OTP and Position Conversion

- Short term and Long-Term Capital Gains

- STCG and LTCG Taxes

- Tax Harvesting and Offsetting

- Tracking trending sectors

- Delivery stock screener

- Delivery watchlist creation

- BTST using Data

- News and Event Analysis

- Range breakout strategy

- Breakout and retest strategy

- Trend following strategy

- Entry Price, Stoploss and Target Decision

- Quantity, Money, and Risk Decision

- Using MTF for delivery trading

- FII DII activity for delivery trends

- Order Placement and Entry timing

- Position Management and Tracking

- Performance tracking and Journal

- Profit Reinvestment and Payouts

- Intraday Leverage

- Intraday News and Events

- Understanding Intraday Heat Map

- Preopen and Global Data Analysis

- Multiple Timeframe Chart Analysis

- Decision on Trading Direction

- Intraday Price action scanner

- Intraday Breakout Breakdown Strategy

- Trading in pre-selected gainers losers

- Entry Price, Stoploss and Target Decision

- Quantity, Money and Risk Decision

- Order Placement and Entry timing

- Position Management and Tracking

- Performance tracking and Journal

- Profit Reinvestment and Payouts

- Understanding Future contract

- Equity Derivative selection criteria

- Payoff Charts, Max Profit and Loss

- Underlying Asset, Spot Price

- Lot Size and Contract Value

- Margin, Margin Rate, MTM Settlement

- Parallel Contracts, Contract Cycle

- Cash and Physical Settlement/ Exercise

- Option contracts – Call and Put

- American vs European Options

- Option payoff charts

- Strike Price and Moneyness

- ATM, ITM, OTM options

- Understanding Option Chain

- Open Interest and Option Volume

- Market Wide Position Limits

- Intrinsic value and Calculations

- Time value, Volatility value

- Option Premium and Margin

- Option Delta

- Delta and Moneyness Correlation

- Using delta concept in trading

- Option delta acceleration

- Moneyness and Delta Acceleration

- Delta Summation properties

- Option Gamma

- Gamma vs Moneyness correlation

- Option Vega

- Vega vs Moneyness properties

- Calculation of Option Greeks

- Option theta

- Theta vs Moneyness

- Properties of Option Greeks

- Implied volatility concept

- What is Open interest (Derivatives: Futures)?

- Put Call ratio

- Open Interest for Levels

- Long Built-up and Short Built-up

- Long Unwinding and Short Covering

- Combining price action with OI data

- Open interest vs Volume

- Volume & Open Interest Dynamics

- Open Interest buildup screeners

- Building a Watchlist: Filtering Stocks for Intraday

- Building a Watchlist: Filtering Stocks for Delivery

- BTST & STBT strategy using Open Interest (OI)

- Index Contributors and Open Interest Data

- Finding Support Resistance using Open Interest

- Finding Trend with OI Data

- Max Profit, Max Loss Calculation

- Breakeven calculation

- Margin and risk –reward for strategy

- Two Leg & Multi- Leg Strategies

- Two Leg & Multi- Leg Strategies

- Put long and short

- Bear call spread

- Bull Call Spread

- Bear Put Spread

- Bull Put Spread

- Long straddle

- Long strangle

- Short straddle

- Short strangle

- Short iron condor

- Hedging futures with options

Best Trading Course related FAQ’s

No, we start from the foundation and gradually move to advanced levels.

Yes, we do! You can attend our live demo session to experience our teaching style, meet the mentor, and understand what the course offers.

Yes, we include live chart breakdowns and real-time market case studies.

The share trading course is delivered through both online and offline batches. You can choose the format that best suits your learning preferences.

No recordings are available under any circumstances

Yes, we offer live class repetition for up to 3 months after course completion. If you miss a session or want to revise any topic, you can attend the same class again in upcoming batches for free.

You can pay securely via: UPI (Google Pay, PhonePe,) Debit/Credit Cards, Net Banking. We use a secure payment gateway to ensure your transaction is safe and seamless.

Our Share Market Courses are taught by best instructors and market experts with a wide experience of more than 15+ years in this industry.

Yes, upon successful completion of the share market trading course, you will receive a certificate that recognizes your achievements and skills acquired during the program.

You can enrol directly on our website by clicking the “Apply Now” button. Alternatively, feel free to contact us directly at 7068001919 for assistance with your enrollment.

Join Thousands Who Transformed Their Trading Journey!

EXCELLENTTrustindex verifies that the original source of the review is Google. good 👍Trustindex verifies that the original source of the review is Google. Learning under the guidance of highly qualified teachers like Mahesh Sir has been an enriching experience. His practical and realistic approach to explaining concepts provided deep insights into market functions, analysis, and trends. I am eager to further enhance my knowledge in the upcoming advanced class.Trustindex verifies that the original source of the review is Google. This is an honest review about this academy and the course which I completed just couple of days ago. Initially, I was very sceptical to take this course as my previous experience with other institutes was not good. Whatever courses I saw or attended was just theoretical or about paper trading. No strategies was introduced or explained. Instructors were in hurry to complete the lectures. But here, at Wealthnote, it was completely different. Instructor was well knowledgeable and explained each and every concepts in such a manner that even a layman would be able to understand it. Each and every doubt was addressed very patiently doesn't matter if it was a dumb question or repeated one. Difference I saw in myself after completing the course was that now I feel confident in taking trades either if it's intraday or delivery trades. My each and every concepts are clear now and looks at the market differently now. Thanks to entire team and specially to the instructor for such a great effort. Planning to take advanced course from Wealthnote again.Trustindex verifies that the original source of the review is Google. Best trading class in pune. Everyone one must join. Very well explained.From day 1 till end the teaching was excellent concepts very accurately expained. Input was good so the outcome was excellent. Could exsecute indradayand delivery trade with perfect analysis of fundamental and tecnical analysis. And now can trade with confidence and decipline. The support staff is also excellent. Anyone who wont to do trading should must join this class in pune. For good outcome of tradingTrustindex verifies that the original source of the review is Google. I am very happy to share my positive experience at WealthNote institute. Mahesh sir is very supportive and helpful, always helps in clearing the doubts of everyone. The class is also very neat and clean and location is also in the heart of the city. I highly recommend WelathNote Institute for any queries related to stocks and investment.Trustindex verifies that the original source of the review is Google. The share market class offers valuable insights into the workings of financial markets, providing students with a strong foundation in stock trading, investment strategies, and market analysis. By learning about fundamental and technical analysis, market trends, and risk management, participants can make more informed decisions in their personal investing journeys. This class is especially beneficial for those seeking practical knowledge to navigate the world of equities, understand market indicators, and build long-term wealth through disciplined investing.Trustindex verifies that the original source of the review is Google. It has wonderful experience to learn basic steps from Mahesh sir..... thanku sir for your guidence.....Trustindex verifies that the original source of the review is Google. ExcellentTrustindex verifies that the original source of the review is Google. Excellent class by Mahesh sir.Trustindex verifies that the original source of the review is Google. Good Teaching and Excellence Guidance