The stock market has become one of the most exciting ways to grow wealth, and in recent years, IPOs have gained massive attention among new investors. Every time a popular company announces its IPO, social media buzzes with excitement, and people rush to apply—hoping for listing gains or long-term profits. But what exactly is an IPO, and is it truly a good idea for beginners to invest in one?

If you are just starting your financial journey—or planning to join share market classes in Pune to improve your understanding—this blog will give you a simple yet complete explanation of IPOs, how they work, and whether they are suitable for first-time investors.

What Is an IPO?

IPO stands for Initial Public Offering. It is the process through which a private company becomes publicly listed on a stock exchange for the first time. When a company launches an IPO, it offers shares to the public to raise capital. Investors who buy these shares become part-owners of the company.

In simple terms:

- Before IPO → The company is private

- After IPO → The company is public, anyone can buy or sell its shares

Companies launch IPOs for several reasons:

- To raise funds for expansion and growth

- To reduce debt

- To build a public identity

- To provide an exit option for early investors and founders

Understanding how IPOs work is an essential part of stock market education, which is why top share market academy programs focus heavily on IPO analysis.

How Does an IPO Work?

To understand whether beginners should invest in IPOs, it’s important to know the process:

1. Company Selection

A company decides it needs funds and chooses to go public.

2. Hiring Investment Banks

Banks evaluate the company and help decide the IPO price band, number of shares, and valuation.

3. SEBI Approval

The company must follow strict rules and receive approval from market regulators.

4. Subscription Period

Investors apply for shares through their Demat accounts.

Subscriptions are divided into:

- Retail Investors

- Institutional Investors

- Non-Institutional Investors

5. Allotment

If demand is high, allotment happens via lottery.

If demand is low, investors may get full allotment.

6. Listing Day

The shares get listed on the stock exchange (NSE/BSE), and the price may open higher, lower, or equal to the issue price.

Learning these steps is part of the curriculum in many Stock Market Institute in Pune training programs.

Why Do Beginners Get Attracted to IPOs?

1. Possibility of Quick Listing Gains

Many IPOs list at a premium, giving instant profits.

2. Brand Value

Famous companies attract investor curiosity.

3. Low Entry Point

IPO prices are often affordable for new investors.

4. Social Media Buzz

Hype influences many beginners to apply without analysis.

But the bigger question remains…

Should Beginners Invest in IPOs?

The answer is yes—but with proper knowledge. IPOs can be profitable, but they also come with risks. Here is what beginners should consider:

✔ Pros of Investing in IPOs

1. Opportunity to Invest Early

You invest at the ground level before the stock becomes expensive.

2. Potential Listing Gains

If the demand is strong, the stock may open at a higher price.

3. Strong Long-Term Returns

Some of the biggest Indian companies (like Infosys, TCS, and HDFC Bank) rewarded early investors massively.

4. Transparent Information

Companies must disclose financials in the DRHP, giving clarity about performance.

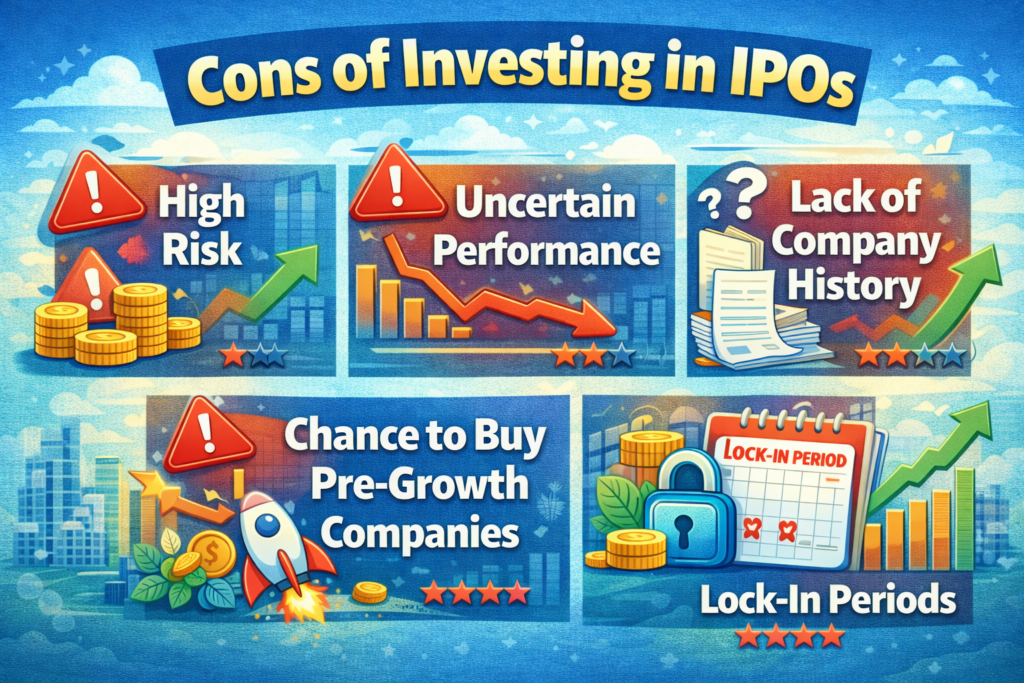

✔ Cons of Investing in IPOs

1. Lottery-Based Allotment

High demand means you may not receive shares.

2. Overhyped IPOs Can Drop

Some IPOs list at a discount, causing instant losses.

3. No Historical Data

Since the stock is new, long-term price behaviour is unknown.

4. Emotional Decision-Making

Beginners often invest based on hype instead of analysis.

This is why structured training—like joining a share market academy or share market classes in Pune—helps beginners develop the right analytical approach.

How Beginners Should Approach IPO Investing

1. Read the Company’s DRHP

This document shows financial performance, risks, and objectives.

2. Check the Company’s Profitability

Is the business profitable or just growing without earnings?

3. Look at Industry Trends

Good companies in booming industries often perform better post-listing.

4. Avoid Investing Based on Hype

Always rely on data, not emotions.

5. Take Guidance from Experts

A reputed stock market institute in Pune can help you understand IPO valuation, financial statements, and business models.

- Final Thoughts

IPOs are an exciting way to begin your investment journey, but only when approached with the right knowledge. They offer great potential—both for quick gains and long-term returns—but also come with risks that beginners often overlook.If you are serious about learning stock market concepts, analysing IPOs, and making confident investment decisions, enrolling in professional share market classes in Pune or a trusted share market academy can guide you in the right direction. A good stock market institute in Pune will help you build strong fundamentals, understand company valuations, and make smart, profitable decisions.