Advanced Share Market Trading Course

- Home

- >>

- Courses

- >>

- Advanced Share Market Trading Course

Duration

4 Weeks/2 Hours Daily

Modules

No. of modules - 15

Training

Online & Offline Batches

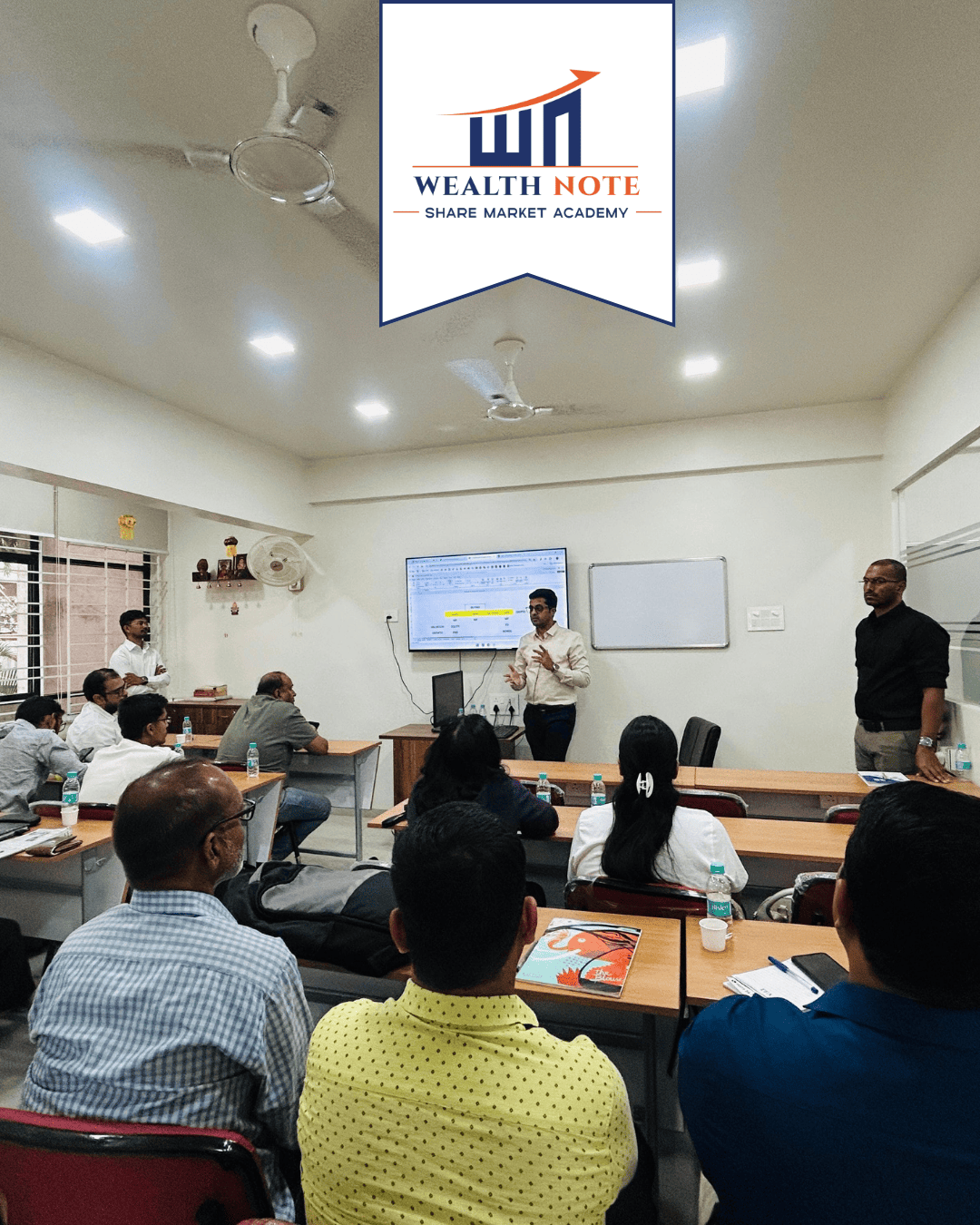

Advanced Share Market Trading Course

Unlock your trading potential with our comprehensive Advanced Share Market Trading Course covering Equity Trading and Futures & Options (F&O) Trading. This all-in-one course helps you understand how the stock market works and teaches you to analyse trends, manage risks, and create profitable strategies using AI-based trading tools. Through simple lessons, real examples, and live market sessions, you’ll gain practical skills in equity and derivatives trading. Perfect for both beginners and experienced traders, this course will help you trade smarter and build confidence in the Indian stock market.

This Course is designed for

Salaried Professional

Businessmen

Students

Housewives

Engineers

MBA Professional

Charted Accountants

Retired Individuals

Modules

- Share market and its function

- Exchanges, Brokers, Investors

- Trading, Demat account

- Intraday, Delivery and Investment

- Bull vs Bears, Long vs Short

- Intraday vs Delivery Settlement

- Market Cap – Large, Mid, Small

- Volume, Turnover, Market Depth

- Price Bands and Circuit Filters

- Quarterly Settlement, Zeroizing

- Index - Broad and Sector

- Index calculations and contributors

- Leverage, Margin, MTF

- Leverage on shares

- Candles – Open, High, Low, Close

- Trading View Website Demo

- Trading Strategy – Trend, Level, Signal

- Candle Patterns, Support and Resistance

- Trend Lines – Up trend and Down trend

- Support, Resistance and Trendlines

- Uptrend, Downtrend, Sideways trend

- Breakout, Breakdown and Bumps

- Moving Average Indicator

- Moving Average Convergence / Divergence

- Average True Range Indicator

- Trend Momentum Combination

- Relative Strength Index Indicator (RSI)

- Golden and Death Crossovers

- Volume and Weighted Volume

- Volume Weighted Average Price

- International Events and News

- Geopolitical Events and News

- Government Announcements

- Crude Oil, Natural Gas Data

- Bullion and Metals Data

- Currency News and Data

- Federal Bank Commentaries

- Inflation, Interest Rate Data

- Monetary Policy Events

- GDP Growth Data

- Import Export Data and News

- Sector Data and Events

- Company Specific News and Events

- Quarterly and Annual Results

- FII and DII inflow outflow

- Insider Trading, Bulk Deals

- Stock Price vs Business Performance

- What are Annual Reports, Financial Statements

- Balance Sheet: Assets and Liabilities

- How to Read a Profit and Loss Statement

- Cash Flow Statement: Operating, Financial

- Key Financial Ratios: ROE, ROCE, ROA etc

- Valuation Ratios: P/E, PEG, P/B Ratio

- Sector and Industry Analysis

- Understanding Business and Revenue Models

- Understanding Growth and Scalability

- Business Cycles and Trends

- Economic Moats and Competitive Advantages

- Shareholding Pattern and Institutional Activity

- Corporate Actions and Announcements

- Checklist Approach to Investing

- Introduction to AI in Finance

- Set of AI tools

- Use of AI tools for Stock selection (Trading & Investment)

- AI to gauge Sentiment & News Analysis

- Use of AI for Company Comparison

- Use of AI to understand Sector & Industry

- AI for Technical Analysis

- WealthNote- WN Market Rhythm Indicato

- WealthNote- WN D&S Indicator

- Watch-List Creation Intraday, Delivery & Investment.

- Importance of Savings

- Time value and Compounding

- Rules of Money Management

- Mutual funds for all needs

- Insurance – Life, health, motor

- Investing and Trading Allocation

- Delivery and Intraday Allocation

- Equity, Currency, Commodity Allocation

- Reinvesting of Profits and Reallocation

- Importance of Risk Management

- Reward to Risk ratio, Win Rate

- Use of ATR Indicator for Stoploss

- Quantity control for managing risk

- Time value of money

- Profit maximizing by trailing stop loss

- Trading App and Website Demo

- Funds Pay in and Payout

- Margin and Collateral Utilization

- Symbol Info and Market Stats

- Market, Limit and Stoploss Orders

- Intraday, Delivery and MTF Orders

- Disclosed Quantity, Order Validity

- Limit, Market and Stoploss Orders

- Order Book, Pending and Executed Orders

- Day and Net Positions, Holdings Window

- Ledger Statement and Narrations

- Profit and Loss statement in all segments

- Understanding Contract Note

- Understanding all costs and taxes

- POA OTP and Position Conversion

- Short term and Long-Term Capital Gains

- STCG and LTCG Taxes

- Tax Harvesting and Offsetting

- News Analysis

- Understanding Intraday Heat Map

- Preopen and Global Data Analysis

- Understanding Market Sentiment

- Decision on Trading Direction

- Intraday Price action scanner

- Watchlist Creation for Intraday Trading

- Watchlist Creation for Delivery Trading

- Multiple Timeframe Chart Analysis

- Entry Price, Stoploss and Target Decision

- Quantity, Money and Risk Decision

- Order Placement and Entry timing

- Position Management and Tracking

- Performance tracking and Journal

- Profit Reinvestment and Payouts

- WN Compounding Strategy (Trading & Investment)

- Understanding Future contract

- Equity Derivative selection criteria

- Payoff Charts, Max Profit and Loss

- Underlying Asset, Spot Price

- Lot Size and Contract Value

- Parallel Contracts, Contract Cycle

- Margin, Margin Rate, MTM Settlement

- Cash and Physical Settlement/ Exercise

- Open Interest and Option Volume

- Market Wide Position Limits

- Directional Trading Strategy

- Stock selection Criteria

- Arbitrage Strategy

- Spread Trading Strategy

- Portfolio Hedge

- Equity & Futures Trading using OI

- BTST/STBT

- Watch list creation using OI

- Option contracts – Call and Put

- American vs European Options

- Option payoff charts

- Strike Price and Moneyness

- Understanding Option Chain

- ATM, ITM, OTM options

- Open Interest and Option Volume

- Intrinsic value and Calculations

- Time value, Volatility value

- Option Premium and Margin

- Option Delta

- Delta and Moneyness Correlation

- Using delta concept in trading

- Option delta acceleration

- Moneyness and Delta Acceleration

- Delta Summation properties

- Option Gamma

- Gamma vs Moneyness correlation

- Option Vega

- Vega vs Moneyness properties

- Calculation of Option Greeks

- Option theta

- Theta vs Moneyness

- Properties of Option Greeks

- Implied volatility concept

- What is Open interest (Derivatives: Futures)?

- Put Call ratio

- Open Interest for Levels

- Long Built-up and Short Built-up

- Long Unwinding and Short Covering

- Combining price action with OI data

- Open interest vs Volume

- Volume & Open Interest Dynamics

- Open Interest buildup screeners

- Building a Watchlist: Filtering Stocks for Intraday

- Building a Watchlist: Filtering Stocks for Delivery

- BTST & STBT strategy using Open Interest (OI)

- Index Contributors and Open Interest Data

- Finding Support Resistance using Open Interest

- Finding Trend with OI Data

- Max Profit, Max Loss Calculation

- Breakeven calculation

- Margin and risk –reward for strategy

- Two Leg & Multi- Leg Strategies

- Put long and short

- Bear call spread

- Bull Call Spread

- Bear Put Spread

- Bull Put Spread

- Long straddle

- Short straddle

- Long strangle

- Short strangle

- Short iron condor

- Understanding Intraday Heat Map

- Preopen and Global Data Analysis

- Understanding Market Sentiment

- Decision on Trading Direction

- Watchlist Creation for Stock Options & Index Options Trading

- Strike price (contract) selection using option chain, OI and volatility

- Multiple Timeframe Chart Analysis

- Entry Price, Stoploss and Target Decision

- Quantity, Money and Risk Decision

- Order Placement and Entry timing

- Position Management and Tracking

- Performance tracking and Journal

Why Select Wealth Note Share Market Classes in Pune

Comprehensive Learning

AI-Based Tools

Practical Approach

Interactive Learning

Flexible Learning Options

Enroll Now

FAQs related to Advanced Share Market Trading Course in Pune

Anyone interested in the stock market can join — whether you are a beginner, student, working professional, or experienced trader looking to improve your skills.

You will learn equity market fundamentals, Futures & Options Trading concepts, Technical and Fundamental analysis, risk management, and how to use AI-based trading tools for better

decisions.

Yes, you will get to attend live market sessions where you can practice what you learn and understand real-time market movements.

Yes, absolutely! The course is designed with flexible class timings so you can learn even if you’re a full-time student or professional. We have both online & Offline batches for flexible learning

Yes! After completing the course, you will have the knowledge and confidence to trade independently in equities and F&O markets.

Yes, we offer live class repetition for up to 3 months after course completion. If you miss a session or want to revise any topic, you can attend the same class again in upcoming batches for

free.

You can directly contact us on: 7068001919 or visit our Wealth Note Share Market Academy for

in-person assistance.

You can pay securely via: UPI (Google Pay, PhonePe,) Debit/Credit Cards, Net Banking. We use a secure payment gateway to ensure your transaction is safe and seamless.

No, class recordings are not provided. We believe in live, interactive learning, where students can ask questions, clear doubts instantly, and practice concepts in real time during sessions.

Yes, many of our students go on to trade professionally or manage their own portfolios using the skills learned here.

Request A Call Back

Just Submit your mobile number and we'll be in touch shortly.

Join Thousands Who Transformed Their Trading Journey!

Himanshu Shukla

This is an honest review about this academy and the course which I completed just couple of days ago. Initially, I was very sceptical to take this course as my previous experience with other institutes was not good…

GHANASHYAM S

Sir explained the concepts clearly and I was able to understand the topic better. The class was very informative and thought-provoking. It encouraged me to think more deeply about the topic. I appreciated how Sir connected theory…

Arav Kamesh

First time coming here and had a great time here food is really good and comforting and ambience is also really good Our hosts suraj and naksto gave us the best service and got all our orders on time..

Varsha Sonawane

Best trading class in pune. Everyone one must join. Very well explained.From day 1 till end the teaching was excellent concepts very accurately expained. Input was good so the outcome was excellent..

Vedant Phale

I am very happy to share my positive experience at WealthNote institute. Mahesh sir is very supportive and helpful, always helps in clearing the doubts of everyone….

Puneet Beniwal

The share market class offers valuable insights into the workings of financial markets, providing students with a strong foundation in stock trading, investment strategies, and market analysis…

Ayush Mahadik

Best food quality Nice service by shoaib

Rahul Kurne

Best share market class in Pune. If you are new to stock market then this class will be very beneficial for you. The staff here are very supportive and focus on teaching you how to choose your own share without spoon feeding…